02 Mar

Ultra-fast Delivery: How to Accomplish in 10-15 Minutes

March 2nd, 2022

COVID-19 pandemic has changed our lives in many ways. It has also opened avenues of extensive delivery. Rather than slogging through the departmental stores and standing in long queues only to buy weekly essentials, people now prefer to go online and place delivery orders.

In this blog, we’ll cover:

Ultra-fast Delivery: Accomplish Deliveries in 10-15 Minutes

COVID-19 pandemic has changed our lives in many ways. It has also opened avenues of extensive delivery. Rather than slogging through the departmental stores and standing in long queues only to buy weekly essentials, people now prefer to go online and place delivery orders.

Online delivery services are now committed to ultra-fast delivery within 10-15 minutes to stay ahead in the competitive market.

But, would it be possible to match the deliveries of massive brands like Amazon and Walmart? Well, it all depends on technology and your outlook.

How Does Speed Of Delivery Matter?

According to research, customers are highly likely to move their business away if they face longer times of delivery. There are plenty of options to shift the business from one service provider to another. Furthermore, more than 90% of customers expect delivery within 2-3 days, whereas 30% prefer same-day delivery . 1

Grocery stores witness more intense speed expectations. Key players like Zapp, Jiffy, Dijanow, and Grovy offer grocery as well as food delivery in less than 15 minutes. Grovy even gloats a 10-minutes commitment.

These brands are not just completing ultra-fast deliveries, but they are also maintaining sustainability. Jiffy, for instance, promises 15-minutes delivery using e-bikes for delivering groceries within a radius of 2-mile. Likewise, Zapp also uses biodegradable paper bags to deliver groceries. Dija also maintains a sustainable approach with electric vehicles and donates surplus food to associating charities. All of them are in collaboration with Olio for reduced food wastage and Planetly that reduces carbon footprint.

10-15 Minutes Deliveries: The Real Challenge

While this sounds too good to be true, the challenge is real. Businesses have to be equipped to manage ultra-fast delivery models to ensure the ease of workers.

If the goal is quick delivery, businesses should adopt online ordering systems, eCommerce systems, last mile delivery, and pick & pack delivery operations. These models work.

However, the greater challenges lie here:

- Assembling and handling customer data and informing business decisions

- Pick & Pack logistics

- Upholding high standards of inventory

- Storing grocery items at the optimum temperature

- Fine margins

Moreover, speedy delivery does not require a large inventory. Only a store for pickup and fulfilment can speed up the delivery process in no time. But some drawbacks still exist:

- Stores may have lower rates of inventory accuracy

- In-store picking costs may be very high

- Stores may not be equipped for handling the process of fulfilment which may lead to inaccurate picks in peak shopping hours

Honestly, a business can only master ultra-fast delivery with far-reaching

optimisation of inventory placement across networks.

Solutions to Ultra-fast Delivery

Although you do not have overwhelming resources of Target, Walmart, and Amazon, you can still manage 10-15 minutes delivery with precise technology. The strategy is to discover a solution to solve these challenges related to the development, launch, and scaling of the ultra-fast delivery operation.

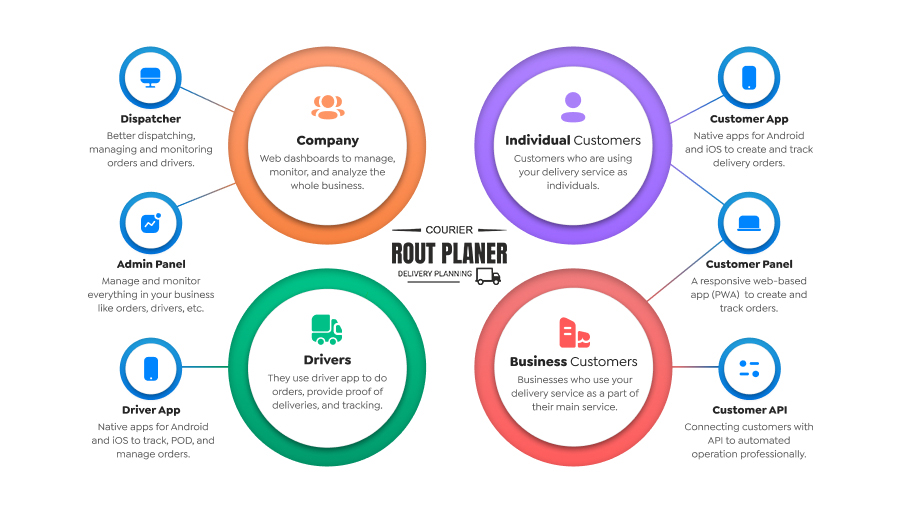

Advanced routing is an excellent solution to achieve remarkable improvements using an integrated approach to route optimisation, real-time data with tracking, auto-dispatch, AI-enabled predictive ETAs, tools for customer communication, complete data analytics, delivery proof, and so on.

With the ultra-fast delivery model, every second matters. The delivery management structure should help businesses upsurge their professional efficiency while delighting customers through owned experience of last mile delivery.

Dark Stores Assist Ultra-fast Delivery

If you are looking for a helpful solution, dark stores are the answer. It can help you with all your inventory challenges for 10-15 minutes delivery. You can close your store, switch to the fulfilment centre, and speed up your delivery times.

Although this format is still being tested in large organisations like Bed Bath & Beyond and Walmart since pre-covid times, it has fast become the most popular way of streamlining delivery during the pandemic.

Dar stones also combine multiple store benefits and warehouses aimed at pick and pack, thus allowing businesses to deliver products at a lightning speed.

Cost & Other Factors

Quick commerce is an urban phenomenon, primarily concentrating on Tier I cities having gated communities. However, investing in the dark stored heavily within a radius of a few kilometres of the hotspots can go only that far. In these large and gated communities or apartment complexes, 10-15 minutes delivery services would compete with the local kiranas and even some shopping malls.

Moreover, operational costs and monthly rent of these stores are determinant factors. Human costs, transport expenses, transport, and inventory logistics are additional expenses. The human cost would comprise the workforce needed to pack carts and load the same. In addition, it would also include delivery partners. In businesses with a thin margin, even the cost of fuel can make a difference. This is probably the reason to apply a minimum order value to get free delivery.

With companies like DoorDash doing a phenomenal job with ultra-fast delivery of groceries, it seems that customers are willing to shell out a little more. Moreover, employees are happy to receive handsome hourly pay for their delivery services through a subsidiary instead of a contract. They can also use e-bikes for delivery, which is eco-friendly and economical. Other companies eyeing these services and wanting to make the most out of them should adopt these strategies for excellent returns.

Ultra-fast delivery also evolved as another big battleground for start-ups like Getir, Gorillas, GoPuff, Jokr, Buyk, and Fridge No More. However, despite the rising number of new entrants into this space, some members seemed dubious about the model and its fundamentals. Especially when it comes to profits, members seem to have too many questions, as the business model does not stack up.

Nevertheless, while DoorDash focuses on rapid delivery, others seem to be moving ahead. GoPuff, a venture-backed company, received $15 million worth of funding round, in collaboration with Uber Eats for delivering the orders of convenience stores through more established apps.

The new element launched by DoorDash is called DashMart. It would facilitate 10-15 minutes delivery, covering restaurants, convenience stores as well as other retailers. The warehouse holds an inventory of 2000 useful grocery items as well as essentials together with branded restaurant and convenience products.

All in all, the future looks bright. Proper strategy and execution would be the key elements, albeit.

Source:

1) https://www.mckinsey.com/industries/retail/our-insights/retail-speaks-seven-imperatives-for-the-industry